what happens to the eoq when the unit cost increases

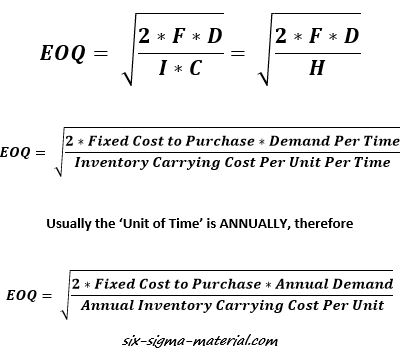

Economic Order Quantity (EOQ)

Objective:

Determine the optimum level of ordering frequency and amount of units. The amount of units is called the Economic Order Quantity (EOQ) or Economic Lot Size (ELS).

Units may exist pieces, items, each, widgets, etc. It is calculated specific to each product (unless all the variables happen to exist the same for more than one product).

The proper apply of EOQ by production is essential for an constructive JIT program. At that place is one basic unremarkably accepted formula simply it relies on accurate inputs and relates more than for buying and unmarried-stride manufacturing .

The formula is simple. However the inputs tin can be challenging to become right.....and they change over time. Since these variable change, EOQ calculations must be constantly reviewed and updated. Some elementary software with inputs entered into on a regular footing is all that is needed.

Every bit with many formulas there are key assumptions and limitations. For the simple EOQ formula shown above we assign the following:

EOQ = Economical Order Quantity (or ELS for single-step manufacturing).

- F = Costs to execute an Order or Acquisition Costs (Fixed Costs per EOQ Batch)

- I = Inventory Carrying Charge per unit (expressed equally %)

- C = Price per Unit of measurement ($/unit)

- H = Property (Conveying) Costs per Unit per Unit of Time* = I * C

- D = Demand per Unit of measurement of Time* (assumed abiding rate of demand)

*The Unit of Time for H and D must exist the same (year, month, etc.)

With the fixed demand rate, shortages tin be avoided by replenishing inventory each time the inventory level drops to zero and this also will minimize the holding cost.

Assumptions:

The following are causeless:

- Known constant demand charge per unit of a units per unit of measurement fourth dimension. Such every bit four,923 pieces per month or 59,076 pieces per yr. In other words, the customer pulls at a constant demand charge per unit.

- Assumed C is the aforementioned for any quantity purchased. This means there is not a minimum social club quantity or quantity discount option.

- The EOQ to replenish inventory arrives on time and all at once when the inventory reaches zero. Lead time is constant.

- No planned shortages and inventory are replenished equally needed. In this case, we presume that holding zero inventory is not allowed for any menstruation of time. Obviously some businesses can take the risk but we volition keep things simple.

- The unit of measurement cost per piece (I) to buy or produce cannot exist zero.

- Conveying cost cannot be zero to use this formula. If it is, which it could be in reality, and then your EOQ is as many equally you can sell immediately. This could be infinite.

CAUTION:

The EOQ described here is similar to an ELS for i production operation. Nevertheless, it is different that the Economical Lot Size (ELS) to produce when a production goes through a manufacturing sequence of more than than one process (that is described later).

For most businesses, the right EOQ should too forestall running out and risking the loss of client revenue by not accept bachelor inventory to sell. The correct EOQ minimizes the company costs while maintaining just the right amount of inventory to see client demand.

Since there is variation in all the inputs, when determining the EOQ it is a good idea to model scenarios using the aforementioned formula but entering more extreme inputs to become a

- WORST case - an unlike case but using plausible numbers that could happen which would provide you a college total costs value.

- Best case - an unlikely case but using plausible numbers that could happen to minimize your total costs

- Ideal case - a most likely scenario for your full costs.

Think of it equally a Confidence Interval.

Determine a lower and upper end and then you lot tin plan to both scenarios with the expectation to fall somewhere between the two boundaries.

An EOQ for one business, or i factory within a business, may vary even if they produce or purchase the same verbal production. Each location has a unique stock-still costs structure and may have a unique carrying costs of inventory.

What you need to know:

The Unit Price per Detail (C) to buy at diverse quantities. Maybe it's 1 cost regardless of volume. That is the simplest case just frequently at that place may be quantity breaks, which usually means a quantity discount if more are purchased at once. Purchasing more than at once may give you a improve unit price but normally means more than conveying costs over the long run since that inventory is probable to sit for a period of fourth dimension. This menses of time may be near zero seconds or several days or years.

Inventory Belongings (or Carrying) Costs (H) or every bit a % of the Unit Cost per Item (I). This value usually comes from the Finance Department. Also referred to as variable costs. When you have cash tied up in appurtenances that are sitting on the shelf waiting to be sold, that costs coin. Money that could be used for other investments, pay down involvement, pay for storage fees, insurance, people to watch the site, taxes, etc.

That is why this may likewise be the opportunity costs where if you didn't spend the money carrying the inventory, how much coin could be made if that coin was used somewhere else? In some cases. the carrying costs may be nil. If yous're fortunate enough to take an east-commerce site where you aren't responsible for inventory or another arrangement where the unabridged EOQ batch ships at once (and you become paid for it all at in one case).

If you get H equally a value from Finance, then yous don't need I and C.

Fixed Cost to Execute an Order of Units (F): Another value commonly provided by the Finance Department This is besides referred to equally the Acquisition Cost per Order. How much does it cost to execute and order from quote, PO, supplier direction, freight, handling, admin costs, etc.

Annual Volume or Need (D) - be careful with this value. This is a Number of Pieces (units, items) over a Unit of Time. Ordinarily it is Pieces / Year. Most importantly the unit of time must be consistent throughout the EOQ formula if you lot determine to use a unit of fourth dimension other than year. Recall almost how much is Business firm (i.east. are you able to sell) and how much is a FORECAST which may not sell. Or the forecast could be also low and thus your actual volume may cease upward beingness more than. This results in determining an EOQ that is lower than optimal.

Perfect World - Reorder Point

Remember from earlier, to keep the example simple, the Lead Time (LT) is assumed abiding. The LT is amount of time between issuing the order and its receipt (and able to ship to the customer). The inventory level at which the order is placed is called the Reorder Point (RP)

If the LT is always the same, the RP equals the lead fourth dimension * demand rate. The key is to keep the "unit of time' consistent. Run into the example below

RP = Reorder Point = LT * D

Example:

If the atomic number 82 time to buy an EOQ of 100 pieces is 50 calendar days and the annual demand is 500 pieces per year, calculate the RP.

First of all, catechumen 500 pieces/twelvemonth to pieces/calendar day. This is ane.37 pieces/day.

RP = LT * D = 50 days * ane.37 pieces/day = 68.5 pcs (round upwardly to 69 pieces)

In a perfect world, the bespeak at which to upshot a new club for 100 pieces is when the inventory is depleted to a level of 69 pieces.

69 pieces volition final just over 50 calendar days if the client demand is one.37 pieces/day. This is a bold supposition since customer need is well-nigh never a constant rate. You lot may choose to take a little gamble to buffer for some variation in the customer need rate and cull 70 or 75 pieces are a RP.

For more data on accounting for Buffer and Safety stock, see our Kanban module.

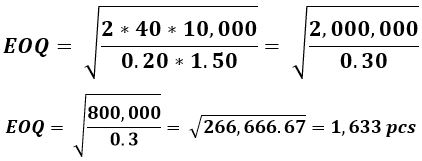

EOQ Adding Example

Determine the EOQ given the following data:

F = the stock-still cost to execute an order costs $40

I = Finance determines the conveying % to be xx%

C = the cost per unit of measurement is $1.50/each to purchase from the supplier

H = Annual Holding (Conveying) Costs = I * C = $1.50 * 0.xx = $0.thirty/each

D = Almanac demand is x,000 pieces

EOQ Calculator

Try it for yourself. Plug in your numbers below.

The calculator in a higher place is a basic version of our advanced version that includes an interactive data readout with a dynamic graph to help illustrate the impact of diverse EOQ's. It allows you to quickly model various inputs and understand a range for your EOQ.

Shown below is the example above. Enter any numbers and you'll come across the touch on to all the outputs and most importantly, the Total Annual Costs.

Visit Templates, Tables, and Calculators to encounter this i and several others.

Discover above, the everyman point in the 'Annual Costs' line is the EOQ which is ane,633 pieces in this case. The 'Annual Costs' is $490 at this EOQ when ordered half-dozen times/year at even time intervals (perfect world example).

Keep in mind the 'Total Unit of measurement Costs' is the same of all EOQ'due south since information technology is just the Almanac Demand of pieces * the Unit Cost per Slice.

EOQ Assumptions/Risks

The following are risks and considerations when determining the EOQ (ELS):

- The annual book (customer pull rate) may change over time. For instance, a 12 month forward plan as of today may appear to exist X units. However, a month from at present the 12 month forward plan may not be 10 units - information technology could be more or less. Therefore it's of import to empathise if the volume is dynamic.....and it usually is. Therefore, it is of import to recalculate the EOQ periodically and try to level load (i.e. produce a consequent corporeality each time) around that EOQ. Some other point to detect is the customer is likely to pull orders from your inventory on a variable pattern. This variation should exist measured and accounted for in the variation. Any variation means that the EOQ needs to exist inflated to cover that hazard unless you tin afford to run out of stock.

- Does the item have a shelf life? If the product tin can but sit in inventory for a limited time, y'all'll need to make sure that the EOQ isn't so big that the inventory is at risks of sitting beyond its shelf life.

- Are there external factors that add risk to your supply chain? such equally the risk of geopolitical events similar tariffs or natural disasters such as hurricanes. Yous may need to purchase or produce more or less early on or filibuster, depending on the data.

- Fixed Cost to execute an social club tin can change . Obviously, every variable can change. This is normally provided by Finance. Ensure to cheque in periodically to get this value updated.

- Holding Costs and opportunity costs can change. Same as above. Endeavour to minimize your conveying costs through smaller batches, less variation, or changing the customer buying policy.

- Tin your concern allow planned shortages without losing money? If so, a greater take chances tin can exist taken on the level of inventory maintained. The formula gets more complicated and is not discussed here.

- The Cost Per Unit of measurement tin modify depending on the quote. Maybe the quote has an expiration date where that could issue in a change in cost. Or there may be a quantity intermission where a lower price could apply with a higher volume of purchase. Maybe you accept dual sourced the item to have a back-upward source just the prices are unlike. In that instance you may calculate a weighted-average cost per unit and use that value for C

The EOQ (or ELS) value is like shooting fish in a barrel to calculate.....once you take the numbers. However, the assumptions are difficult. The EOQ (or ELS) value is only as valid every bit its inputs. At some point, assumptions and agreements demand to be made on the inputs.

Garbage IN - Garbage OUT. Spend the time to get the inputs correct and challenge the assumptions.

Observations

Notice the inputs in the numerator and denominator: A big or minor EOQ is neither good or bad. It depends on your situation and the affect each direction has on your inputs.

If F increases (D and H are constant) , EOQ increases

Longer set-up times and stock-still costs drive up batch size. Maybe a SMED effect will reduce set-up times thus reducing EOQ.

If F decreases (D and H are constant) , EOQ decreases

This results in more than fix-ups (or buy) simply they are quicker or the cost to execute a buy has been reduced. Maybe you issue a Blanket PO instead of a discrete PO each time. Lower EOQ means less carrying costs. And if there is a quality issue, at that place may be less product to quarantine or scrap.

If D increases (F and H are constant) , EOQ increases

which should be a proficient thing to take more sales and hopefully more turn a profit. You may utilise this every bit an opportunity to negotiate a higher volume discount if buying a product.

If D decreases (F and H are constant) , EOQ decreases

Sales are lower, turn a profit is lower and you may face inflation due to lower volume. The contribution margin is lower per piece. This isn't the ideal style to reduce EOQ (or ELS).

If I increases (C, D and F are constant), EOQ decreases

If the costs to carry inventory increases (lease increased, insurance, labor, taxes, etc.), the EOQ drops to recommended carrying less production at a given time.

If I decreases (C, D and F are constant), EOQ increases

The closer I gets to $0, the more and more than y'all tin can put on the shelf and carry since it is getting close to gratis to carry. Putting anything on a "shelf" isn't likely to be gratis even if information technology'south for a few minutes. If you accept a drop-ship business without any inventory liability then your EOQ is as high as yous can sell. This could exist infinite.

If C increases (D, I, and F are constant), EOQ decreases

If the purchase cost per unit or the variable production costs increase, and so EOQ decreases. Higher costs to manufacture or buy ways you don't want to carry as much on the shelf at any given time. That ties upwards greenbacks sitting on the shelf waiting (and hoping to be sold).

If C decreases (D, I, and F are constant), EOQ increases

If the buy cost per unit or the variable production costs decrease, then you can afford to buy more than at once to carry. Try to negotiate a lower cost and so yous tin can commit to buy more than per order to the supplier. Could exist a win-win.

Recall, I * C = H. This means that I could go downward, merely C goes up to the betoken where H increases and thus the EOQ decreases or vice versa.

ELS for multiple manufacturing operations

If you're manufacturing a production that goes through one step, the ELS is generally applicable. An ELS for one operation may not be platonic for a unlike functioning(s). Information technology's important to build an ELS that optimizes the entire value-stream rather than 1 (or two operations).

At that place isn't a formula that suits every situation. It can exist a complex math trouble which is solvable merely needs input from several departments to get it authentic.

Simply permit's discuss the variables for calculating ELS for multiple operations:

Fixed Cost per Social club - would include costs such every bit Set-Upwardly Time, etc. but it calculated for each process step. If the Fix time for one process is much greater than some other, it is probable to drive up the ELS for the entire value stream.

Unit Price to Produce - instead of Unit Cost to Buy. Summate the variable costs to produce the item at each process stride. Such equally tools, oil, MRO, utilities, etc. This tin be difficult especially when at that place are some semi-variable costs. Don't forget to include direct and indirect costs.

It gets more complicated if the manufacturing process also involves outside operations. Some external suppliers (or processors) may require a minimum batch size or there is a premium to pay. They may also have other irregular fees such as testing fees, certification fees, or monthly surcharges. All these costs need to be role of the conversation when you lot're determining the ELS for that process step.

Consider freight, handling, insurance, and all the costs involved. Information technology ever ideal to come up upwards with a lower ELS than expected but that only creates bug downward the route if it isn't accurate.

Consider the container size or the container of the inputs. For example, if you are stamping information technology may be optimal to run a full coil and utilise that as the ELS, if new gyre replenishment takes a long time. Perhaps this tin can be done as an external fix-up function at another time.

Or a racking device, perhaps a full rack is the best ELS instead of risking running a partially full rack.

Calculate the ELS for each process step. This could generate some surprises and more value-added ideas. Next, discuss Lot Integrity.

Is Lot Integrity required?

In some business organisation, you must maintainLot integrity, in other words you cannot mix lots (or batches). Once you start a batch information technology tin't be mixed with others in downstream operations. It can be cleaved up to smaller lots with traceability but it cannot grow after the get-go functioning. This makes information technology even more challenging.

An ELS that makes sense for i operation will not be optimal for other(s). You'll have to determine with ELS of all the ELSs' offer the best overall financial performance.

If your business organization can mix lots and batches, so try to produce the ELS for each operation when the Reorder Indicate is reached. That way you get the optimal fiscal advantage from each operation. But this isn't always practical.

Summary

If y'all're manufacturing using several processes to make an item, the costs per unit are almost constantly changing.

Variable costs from tooling, labor, utilities, freight, MRO, are examples that change regularly. Some assumption needs to exist fabricated to start the ELS calculation. Periodically all the variables should be updated to reflect a new ELS.

The Lead Time is from the commencement of the first operation to the point the product is saleable. This includes all the not-value added and value added steps (handling, moving, waiting, shipping, testing, etc.). This drives up the Reorder Betoken.

This is another reason the Lean Manufacturing tools of vii-Wastes, Procedure Mapping, Spaghetti Diagram, and Value Stream Mapping, Takt TIme/Load Balancing are valuable.

By just going through this practice with the Six Sigma/Lean Team, you will virtually certainly generate some passionate discussion on new ideas or paradigm challenges. This is exactly what you lot want as a Green Belt/Black Belt.

Contempo Articles

-

Process Capability Indices

Oct 18, 21 09:32 AM

Determing the process adequacy indices, Pp, Ppk, Cp, Cpk, Cpm

Read More than

-

Six Sigma Calculator, Statistics Tables, and Six Sigma Templates

Sep fourteen, 21 09:19 AM

Six Sigma Calculators, Statistics Tables, and Vi Sigma Templates to make your job easier as a Six Sigma Projection Manager

Read More

-

Six Sigma Templates, Statistics Tables, and Half-dozen Sigma Calculators

Aug 16, 21 01:25 PM

6 Sigma Templates, Tables, and Calculators. MTBF, MTTR, A3, EOQ, 5S, 5 WHY, DPMO, FMEA, SIPOC, RTY, DMAIC Contract, OEE, Value Stream Map, Pugh Matrix

Read More

Site Membership

LEARN MORE

Six Sigma

Templates, Tables & Calculators

Six Sigma Certification

![]()

Six Sigma Slides

CLICK HERE

Green Chugalug Plan (ane,000+ Slides)

Basic Statistics

Cost of Quality

SPC

Process Mapping

Capability Studies

MSA

SIPOC

Cause & Consequence Matrix

FMEA

Multivariate Analysis

Central Limit Theorem

Confidence Intervals

Hypothesis Testing

T Tests

1-Way ANOVA

Chi-Square

Correlation and Regression

Control Plan

Kaizen

MTBF and MTTR

Projection Pitfalls

Mistake Proofing

Z Scores

OEE

Takt Time

Line Balancing

Yield Metrics

Practise Exam

... and more than

Statistics in Excel

Need a Gantt Nautical chart?

bakerwitswoompose.blogspot.com

Source: https://www.six-sigma-material.com/Economic-Order-Quantity.html

0 Response to "what happens to the eoq when the unit cost increases"

Post a Comment